These include for example. GST is collected by the businesses and paid to the government.

This Woman Opened Malaysia S Very First Zero Waste Supermarket 1 Million Women Zero Waste Zero Waste Store Supermarket

Zero-rated and exempt supplies The following goods and services are zero-rated.

. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Exports 19 basic food items Illuminating paraffin Goods which are subject to the fuel levy petrol and diesel International transport services Farming inputs Sales of going concerns and Certain grants by government. Zero-rated supplies in UAE VAT refers to the taxable supply on which VAT is charged at zero rate.

But does not include items not necessary for dietary needs such as snack foods liquor sodas candy etc. Your GST return and payment are due for the taxable period ending 30 September. How GST works on a zero rated supply at the wholesale level.

In countries that use a value-added tax VAT zero-rated goods are products on which VAT is not levied. Zero-rated supplies of goods and services are subject to 0 GST. Most fishery products if used for human consumption.

11112013 1248 Standard-rated supplies are goods and services that are charged GST with a standard rate. 40 lakhs and for the supply of services Rs. The sales that require 0 VAT to be reflected on the invoice cover a broad range of different types of products and services.

Some examples of GSTHST zero-rated goods and services are. Zero-rated and exempt supplies The following goods and services are zero-rated. A rate of 0 applies to these supplies.

The existing standard rate for GST effective from 1 April 2015 is 6. Publishing books or magazines. Zero-rated supplies are supplies that are not subject to GST in certain situations.

Examples of goods that may be zero-rated include many types of foods and. Depending on the nature of your services you may be required to determine your customers belonging status ie. They can recover credit back on their inputs.

GST is charged at 0 if they fall within the provisions under Section 21 3 of the GST Act. 20 lakhs and for specified category Rs. You can zero-rate your supply of services ie.

20 lakh and Rs10 lakh. GST Treatment on Government Services. How GST works on a zero rated supply.

Similar to standard rated taxable supplies businesses are allowed to recover the associated input VAT in accordance with the provisions of KSA VAT. A person under the exemption limit of turnover for the supply of goods Rs. Generally all exports of goods and services in UAE will.

Goods and services exempted from VAT are. Printing of brochures leaflets or pamphlets. Zero-rated supplies are taxable supplies on which VAT is charged at 0.

Sale of childrens clothing footwear. This is an extension of the usual 28 October due date All GST dates. Computation of GST on zero rated supply.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Standard-rated supplies Last Updated. The only difference here is that instead of charging VAT at 5 it is charged at 0.

Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under zero-rated list. Exports 19 basic food items Illuminating paraffin Goods which are subject to the fuel levy petrol and diesel International transport services Farming inputs Sales of going concerns and Certain grants by government. Your services are considered international services which are zero-rated ie.

Most local sales of goods and provision of local services in Singapore are standard-rated supplies. Sale of protective helmets for cycling or construction. A taxable supply is a supply of goods or services made in Singapore other than an exempt supply.

Basic groceries - This category includes meat fish poultry cereals dairy products eggs vegetables fresh frozen canned coffee tea etc. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer. Whether the customer is.

A taxable supply can either be a standard rated currently 7 or zero-rated supply. A person who makes NIL Rated and exempt supply of goods and services like fresh milk honey cheese agriculture services etc. It is important to note that not all services provided to overseas customers can be zero-rated.

These are taxable supplies that are subject to a zero rate. GST exemption from registration. Charge GST at 0 only if it falls within the description of international services under Section 21 3 of the GST Act.

Banila Co Clean It Zero Hermo Online Beauty Shop Malaysia Banila Co Beauty Cosmetics Skin Care

Digimon Adventure Digidestined S Digimon Lesser Level Nyaromon Tokomon Bukamon Tanemon Motimon Yokomon Tsunomon And Koromon Tattoo Sleeve Digimon

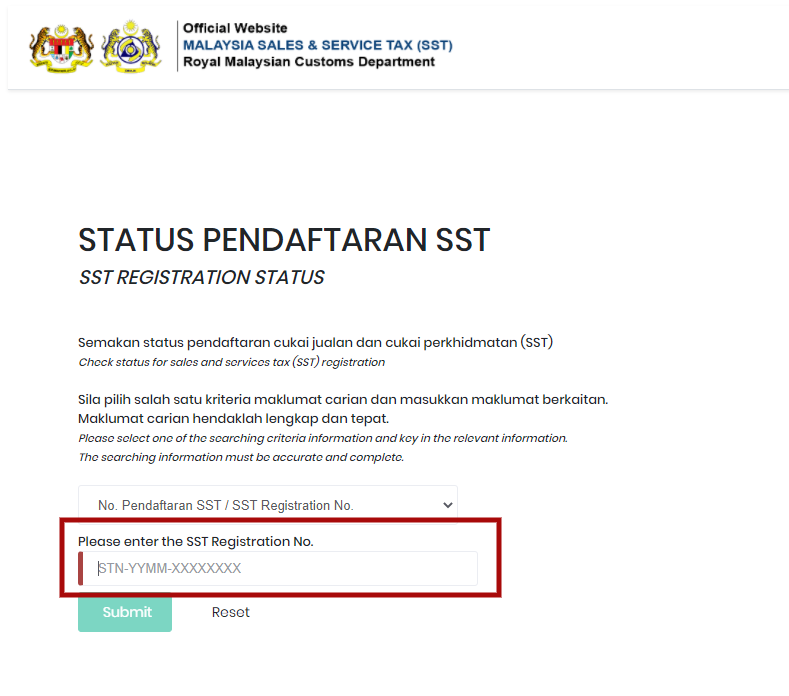

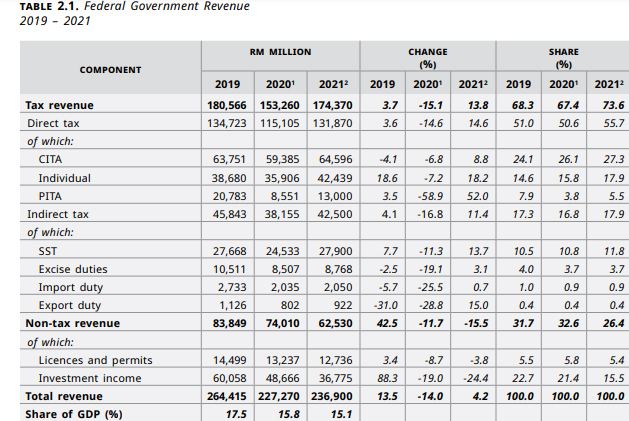

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

11 Simple Ways To Save The Ocean From Turning Into Plastic Soup Save Earth Ways To Save Save Our Oceans

Schottis Dark Grey Block Out Pleated Blind 100x190 Cm Ikea Pleated Blind Dark Curtains Blinds

Tile Stickers For Floor Kitchen Backsplash Bath Removable Etsy

4th Asia Pacific Regional Congress Exhibition Official Site Of The International Road Federation

Xiaomi Mi Band 5 Official Mi Band 5 Watch Face Band Xiaomi

Korean Cosmetics Business Philippines

Malaysia Sst Sales And Service Tax A Complete Guide

Gst In Malaysia Will It Return After Being Abolished In 2018

Tingby Desserte Roulante Blanc 64x64 Cm Ikea Ikea Side Table Ikea Coffee Table Coffee Table With Wheels

Backpacking Singapore And Malaysia Itinerary

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Indirect Tax Guide Kpmg Global